Posts by Dr. Sharyl Truty:

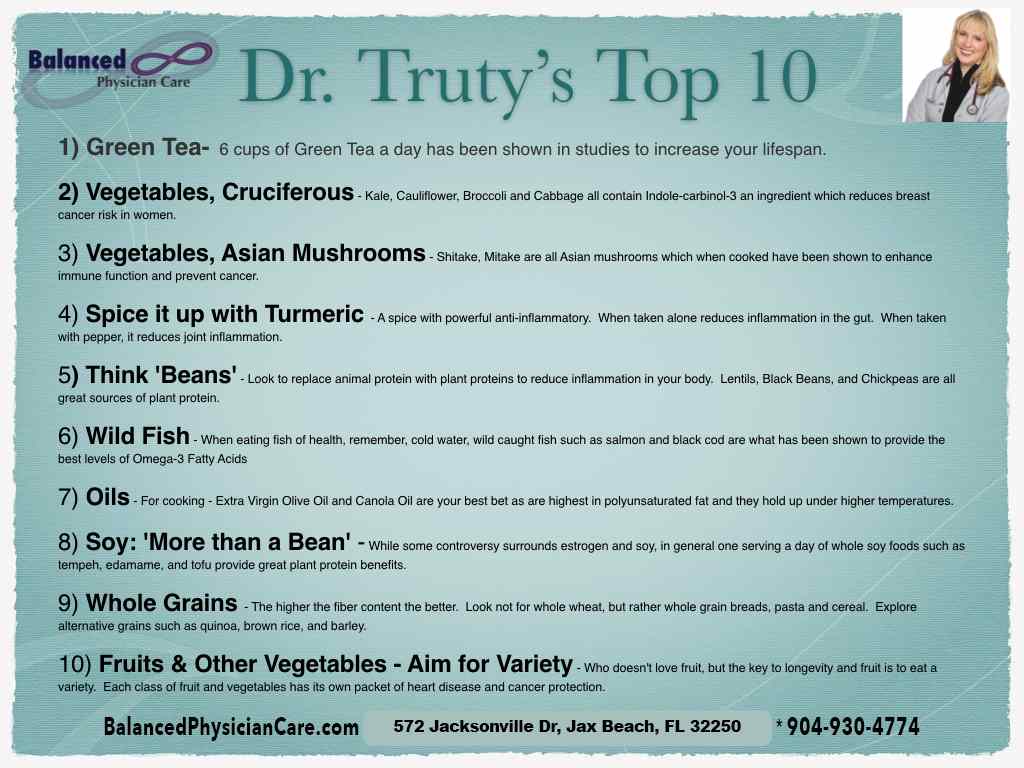

Dr Truty’s Top 10

Inflammation is not always a bad thing – it is necessary when you have an infection or injury, as it helps with healing, directing nourishment and immune activity to the affected site. It is when inflammation is ongoing or chronic, or serves no real purpose, that inflammation can be harmful – damaging the body and leading to illness.

Here are the top 10 anti-inflammatory foods to add to your shopping list

Why QuikTrip Employees Never See a Medical Bill

Employers are often resigned to accept healthcare spending increases year after year, but via a local partnership with Texas Health Resources, Care ATC, and an innovative approach to health insurance, QuikTrip is bucking the trend.

In order to better provide for their employees and their families and save money along the way, QuikTrip processes and pays their own health insurance claims, effectively serving as their own insurance company.

There are several advantages for employers to make this move. They are able to easily access their employees claims information and design the health plan accordingly. They also have discounted direct contracts with hospital systems, including Texas Health Resources in North Texas (QuikTrip’s largest market in terms of stores), reducing costs along the way.

After connecting through a consultant, QuikTrip and THR entered a partnership to provide care. “The quality of our providers, our footprint and the size, and the results that we have demonstrated” were all factors, says THR Vice President of Strategic Growth Jay Beck.

“The ability of the employer to have better connectivity with the provider from the end user,” was essential, Beck says of the direct contract. “There has always been a wall out there.

”Using DPC means that employees are able to visit the clinic as much as they need without adding personal costs, which reduces the larger medical expenses down the line.

QuikTrip also saw the health claims side of their business as a way to keep their employees in the company as they gained more education and experience, essentially adding another industry to the business. “We have always had this mission to provide opportunities to grow and succeed,” says QuikTrip Benefits and Training Manager Brice Habeck.

The company contracts with CareATC direct primary care physicians in North Texas, and even has an onsite direct primary clinic at their headquarters in Tulsa. DPC clinics are incentivized to reduce costs while maintaining quality, as they receive a dollar amount per member per month, which moves incentives away from costly fee-for-service. They also distribute medication onsite in Tulsa at no cost to their employees. Using DPC means that employees are able to visit the clinic as much as they need without adding personal costs, which reduces the larger medical expenses down the line.

In addition to their primary care, QuikTrip utilized capitized arrangements with hospital systems for treatment that is beyond what a primary care physician can provide. This means that providers are paid a set amount for each employee for a period of time, whether the person utilizes healthcare every day or not at all. The arrangement incentives systems to manage the health in a more cost effective way, much like DPC for primary care.

What may be most surprising, is that employees at QuikTrip never see a hospital bill. The company pays all bills directly, and then employees pay the company back. Many of the bills are deducted from future paychecks in the case of larger expenses. Hospital systems have offered better discounts to QuikTrip, as they know they will get paid for the service right away, without battling insurance companies or waiting on patients to pay.

“The ability to collect prompt claims payments was very helpful,” Beck says. “As was the ability to promote our network and be the premier network in the QT member plan.”

While this all sounds ideal, the results are impressive as well. Over the past three years, employees have seen premiums go down, rather than the bending of the cost curve that most employers are hoping for. While they can’t control the cost of care, this model allows for flexibility and discounts that can help control how much the company and its employees pay for healthcare.

According to Habeck, the savings come from people getting care who are normally untreated. Annual physicals and the diagnoses that accompany them, as well as catching non-compliant employees, can reduce pricey visits to the emergency room or other hospitalizations down the line.

In addition, the company prioritizes communication with employees to make sure they are visiting the doctor frequently enough and maintaining their health.

QuikTrip keeps close tabs on their partnerships with providers and their narrow network, discussing at least quarterly how things can improve care and avoid high cost or low quality providers. Habeck sees their plan similar to what Kaiser Permanente has in California with a medical neighborhood, where you never really leave the neighborhood to keep costs down and quality high.

As self-funded employers pay more attention to their healthcare spending, Beck sees larger companies taking more of a role in the administration and payment of their claims. Amazon, Berkshire Hathaway, JP Morgan, and even the city of Fort Worth have made similar moves recently. “It allows for direct connectivity with the provider,”Beck says. “And that direct relationship is mission critical.”

For Habeck, QT’s benefits management line up with the culture of QuikTrip, which prioritizes integrity and serving its employees. Even when things aren’t perfect, the medical partners are able to take responsibility and make a change. “Every single person at the table has the confidence and humility to say I made a mistake,” he says. “It has been a huge step in accountability.”

| Article

DCEO Healthcare

Balanced Physician Care's complete solutions empower small employers to control health benefits costs, while providing Five-Star Primary Care that saves employees time and money as well.

If your company employs 5-300 people, you are in the sweet spot for a Balanced Physician Care Corporate Membership. Give us a call to schedule a FREE no obligation analysis to see if your business can save money, while taking advantage of better health benefits.

Learn More:

904-930-4774

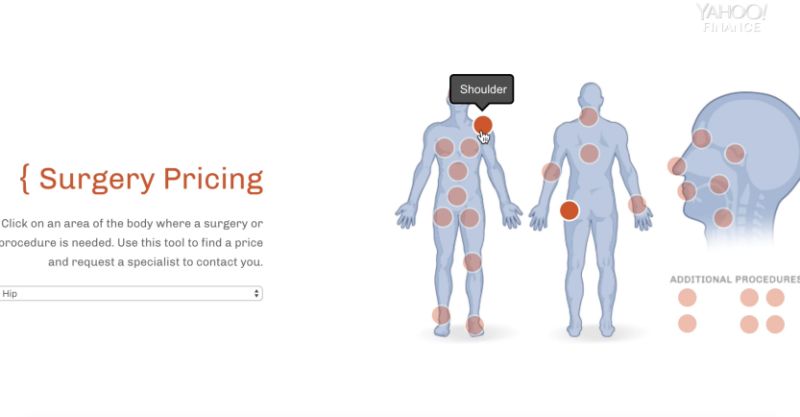

Upfront Surgery Pricing

As Americans grapple with a health care system that costs $10,000 per person annually, a form of health care that avoids the insurance system — known as direct primary care — is starting to become an alternative option.

The American Academy of Family Physicians defines direct primary care as giving “family physicians a meaningful alternative to fee-for-service insurance billing, typically by charging patients a monthly, quarterly, or annual fee. This fee covers all or most primary care services including clinical and laboratory services, consultative services, care coordination, and comprehensive care management.”

The model aims to simplify the system for both health care professionals and patients.

“We have significant bottlenecks and barriers in health care both on the provider side as well as the patient side,” Dr. Akash Goel, a gastroenterologist at Weill Cornell/New York-Presbyterian Hospital, told Yahoo Finance.

“So from a provider perspective,” Goel explained, “people are rightly frustrated because they're overburdened with [a high number of patients], short patient visits, unsatisfactory timelines to interact with patients, pressure from billing and external pressures that I think are on physicians that make the experience somewhat unsatisfactory.”

The direct primary care model is “a little bit more streamlined in terms of receiving your health care,” according to Goel, partly because it limits the number of patients doctors are seeing and gives patients the option to avoid costly insurance plans.

‘We believe the system is broken’

Surgeries handled through the direct primary care method involve patients being able to see the total price for an operation and find a specialist for that price.

At the Surgery Center of Oklahoma, patients do exactly that. They choose surgeries at specific prices and pay a flat rate up front, with no insurance involved. The center was started by anesthesiologists Keith Smith and Steven Lantier. After years practicing medicine, they felt growing “frustration” with the health care system.

“We both started despising what was going on financially with the patients,” Lantier told Yahoo Finance (video above). “Because when you look at the bankruptcy statistics — medical bankruptcies for patients now — it’s egregious. The average American cannot afford health care today, so we believe the system is broken.”

‘The reason we could put it online is because we don’t take federal money’

The Surgery Center of Oklahoma’s website allows potential patients to look up price quotes for all kinds of surgeries. Individuals simply have to click on the area of the body where they would need a surgery or a procedure done, find the exact name of the procedure, and a price is generated. From there, an option appears to request a specialist for further details.

“We took all of the numbers, added them up, then added about a 10 or 15% margin to all of that, and that’s the price we put it online,” Lantier explained. “The reason we could put it online is because we don’t take federal money. If we took any federal money — Medicare or Medicaid — we couldn’t do that.”

-Article by written by Adriana Belmonte, Yahoo Finance, 5/18/2019