It's Open Enrollment season. Providing health benefits for employees is one of the highest expenditures for an employer. With such a significant amount of revenue devoted to keeping staff healthy, employers look to brokers for solutions that support their workforce while also helping their business remain profitable. As the costs of health care continue to escalate, employers and their workers are facing unprecedented challenges.

As businesses pass expenses onto employees, the skyrocketing costs of prescriptions, rising copays, and unattainable insurance deductibles have left many employees feeling neglected. It’s abundantly clear that traditional health plan offerings like high deductible health plans (HDHPs) aren’t enough on their own. A large segment of the population needs health care options that are more affordable and easily accessible.

Employers don’t know how to provide more cost-effective benefits for staff without taking a bigger hit to their bottom line. But by partnering with organizations that offer non-traditional benefits solutions, expert brokers and health care organizations can address clients’ needs for better care while also mitigating costs.

There are innovative ways to create customized plans that are utilized in the staffing service sector and within employer groups such as the three below, where fully-featured health plans aren’t offered.

A better way

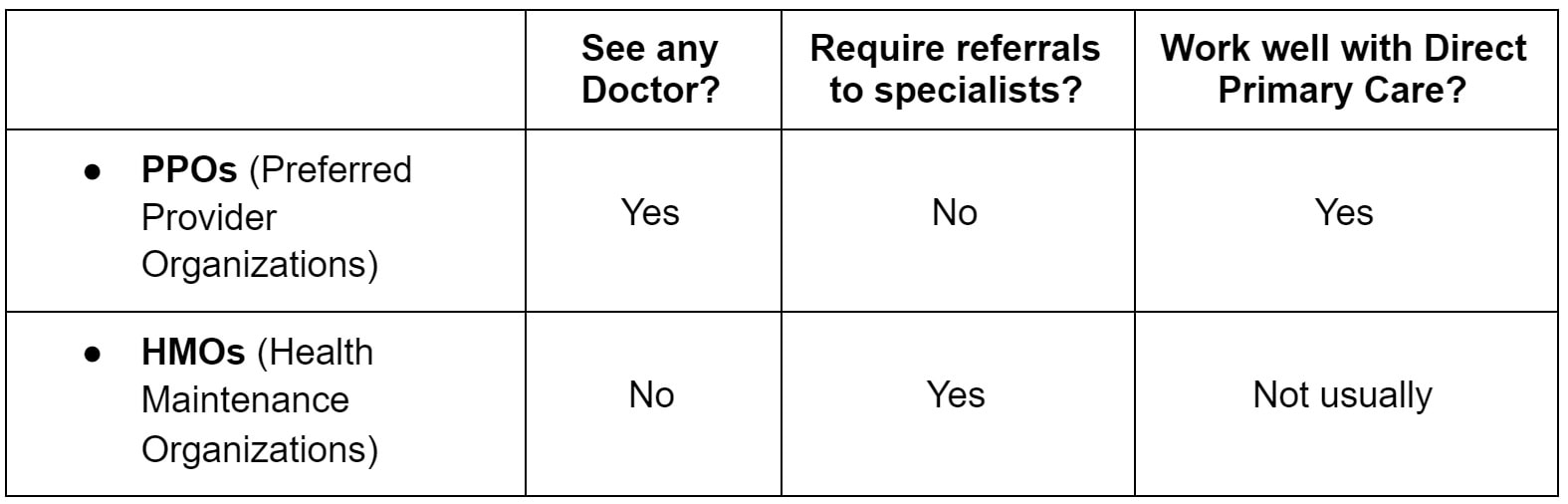

Direct primary care (DPC) has taken the stage as an affordable and more accessible non-traditional health care alternative. Unlike traditional health insurance products, members pay a low monthly fee for unlimited primary care access and there are no premiums or deductibles to meet. There are also no claims for doctors to file or limits to the time they can spend with patients to meet insurance requirements.

DPC can help lower the cost of health plans by mitigating claims. Still, discerning brokers have learned the power of pairing direct primary care with other benefits to make an even more significant impact on health plans. Let’s examine some of these powerful benefit partnerships.

Limited benefit indemnity plans

One powerful ally to a direct primary care plan is an indemnity health insurance plan. This limited benefit plan pays a fixed benefit amount per day to help people cover the cost of standard medical services. Some even provide access to a national PPO discount network to help minimize out-of-pocket expenses.

This benefit is attractive to employees because it can cover services such as hospitalization, surgery, anesthesia, accidents, and other big-ticket items. They can still utilize their DPC membership for unlimited visits to a primary care provider, virtual care, and prescription discounts. Plus, they get the bonus of knowing there’s additional coverage from the indemnity plan if there’s an accident.

Employers like this partnership because it can help them attract and retain talent for a lower cost. They can offer primary quality health care at a minimal cost, and the plan requires minimal administration on their part. These products are also relatively easy to find and implement, as there are already bundles on the market. Check with your direct primary care source to see if they have any DPC/indemnity products available.

Skinny medical plans

Skinny medical plans are group plans that usually cover non-catastrophic health events. These plans can include routine preventive care and wellness benefits. Minimum essential coverage (MEC) plans also fall under this category.

Although far from comprehensive, these plans may appeal to young, healthy consumers because of their lower premiums. Unfortunately, these plans sometimes limit people with preexisting conditions. That’s where pairing them with a direct primary membership can be extremely helpful. Most DPC memberships include maintenance of chronic diseases within manageable ranges, including those with preexisting conditions.

These plans are attractive to companies that employ low-skill workers with high turnover rates. Restaurants, retail operators, hotels, and other hospitality companies can benefit from combining direct primary care with a MEC or another skinny plan.

Hospital indemnity plans

Even a minor trip to the hospital can be a major financial setback for some. HDHPs offer coverage, but the average family often struggles to meet high deductibles in today’s economic climate. Paying a large portion out of pocket for hospital stays can add more hardship to an already stressful situation.

Hospital indemnity plans offer benefits for things like hospital admission, intensive care, and emergency room treatments. There are no deductibles to meet, and employees can also cover their spouses and children under these plans.

By pairing a hospital indemnity plan with a DPC membership, employees can get day-to-day health care for themselves and their dependents for little to no out-of-pocket costs. By utilizing unlimited primary care, people can also catch disease states and other acute conditions before they escalate to the point of requiring a hospital stay. In an emergency, having the added hospital indemnity can provide peace of mind for families already living paycheck to paycheck.

High deductible health plans/self-funding

Companies of all sizes have adopted high deductible health plans (HDHP) as a strategy to reduce the costs of providing health care. A great way to lessen the blow of an HDHP is to insert direct primary care. Others are looking to self-funding/level-funding options coupled with DPC to deflect claims and limit their overall premium expense.

With DPC, employees get day-to-day benefits for routine care. When employees use their DPC membership for primary and preventive care before engaging their HDHP or self-funded plan, they can minimize their out-of-pocket costs and avoid meeting costly deductibles for primary care. It’s also a win for the employer, because the fewer employees that use the health plan for routine care, the fewer insurance claims the employer must pay. Minimizing the cost of primary care for staff and lowering employers’ claims expenses make DPC an ideal partner.

Medical Cost Sharing

Medical cost-sharing plans are sometimes called healthcare ministries. They are not run by insurance companies; they are run by nonprofit organizations. Members pay a set amount into a group fund every month. When a member gets a large medical bill, the fund pays some or all of that bill. Plan guidelines spell out which expenses are shareable.

Before the plan pays out, though, the member must cover some of the cost first. This amount, called the member’s “personal responsibility” or “annual household portion,” works just like a deductible does for health insurance.

People choose these plans instead of health insurance because the monthly charges are usually lower. To control costs, some plans urge members to to join a direct primary care practice.

Times have already changed

Providing equitable and easily accessible health care for employees is no longer optional. Businesses are facing unprecedented challenges to recruit and retain quality talent. In addition to better pay, better benefits will be a determining factor to differentiate one employer from another. As a result, organizations focus on strategies that will help them stand out to candidates without exhausting their resources.

Now more than ever, it’s imperative for brokers to customize solutions for clients. Brokers who lack the savvy to build more cost-effective and robust health plans will lose to their more innovative competitors. Direct primary care is one of many non-traditional benefits that can add value to any health plan. It’s essential to educate yourself on the new options available in the health care marketplace so you don’t get left behind.

Creating custom solutions for clients is easier than you think. There are many options and product bundles available if brokers take the time to look. By expanding the resources available to employers, brokers can foster a partnership in which employers and their employees feel a greater sense of satisfaction with their benefit offerings. Working productively and strategically to offer more, while remaining cost-efficient, strengthens the entire health plan and, hopefully, the organization.