Posts by Alex Minsistrator:

Direct Primary Care Explained to Employers

Direct primary care (DPC) is a solution many progressive companies are implementing to help save money on healthcare costs, while enhancing their benefits package for employees. Although the DPC model has been around for some time, many employers are just beginning to learn about its benefits.

Balanced Physician Care offers businesses membership plans for your employees. To learn more, visit www.HealthcareforJax.com or call our membership specialist, Darren at 904-930-4774.

A Better Way for Employers

It's Open Enrollment season. Providing health benefits for employees is one of the highest expenditures for an employer. With such a significant amount of revenue devoted to keeping staff healthy, employers look to brokers for solutions that support their workforce while also helping their business remain profitable. As the costs of health care continue to escalate, employers and their workers are facing unprecedented challenges.

As businesses pass expenses onto employees, the skyrocketing costs of prescriptions, rising copays, and unattainable insurance deductibles have left many employees feeling neglected. It’s abundantly clear that traditional health plan offerings like high deductible health plans (HDHPs) aren’t enough on their own. A large segment of the population needs health care options that are more affordable and easily accessible.

Employers don’t know how to provide more cost-effective benefits for staff without taking a bigger hit to their bottom line. But by partnering with organizations that offer non-traditional benefits solutions, expert brokers and health care organizations can address clients’ needs for better care while also mitigating costs.

There are innovative ways to create customized plans that are utilized in the staffing service sector and within employer groups such as the three below, where fully-featured health plans aren’t offered.

A better way

Direct primary care (DPC) has taken the stage as an affordable and more accessible non-traditional health care alternative. Unlike traditional health insurance products, members pay a low monthly fee for unlimited primary care access and there are no premiums or deductibles to meet. There are also no claims for doctors to file or limits to the time they can spend with patients to meet insurance requirements.

DPC can help lower the cost of health plans by mitigating claims. Still, discerning brokers have learned the power of pairing direct primary care with other benefits to make an even more significant impact on health plans. Let’s examine some of these powerful benefit partnerships.

Limited benefit indemnity plans

One powerful ally to a direct primary care plan is an indemnity health insurance plan. This limited benefit plan pays a fixed benefit amount per day to help people cover the cost of standard medical services. Some even provide access to a national PPO discount network to help minimize out-of-pocket expenses.

This benefit is attractive to employees because it can cover services such as hospitalization, surgery, anesthesia, accidents, and other big-ticket items. They can still utilize their DPC membership for unlimited visits to a primary care provider, virtual care, and prescription discounts. Plus, they get the bonus of knowing there’s additional coverage from the indemnity plan if there’s an accident.

Employers like this partnership because it can help them attract and retain talent for a lower cost. They can offer primary quality health care at a minimal cost, and the plan requires minimal administration on their part. These products are also relatively easy to find and implement, as there are already bundles on the market. Check with your direct primary care source to see if they have any DPC/indemnity products available.

Skinny medical plans

Skinny medical plans are group plans that usually cover non-catastrophic health events. These plans can include routine preventive care and wellness benefits. Minimum essential coverage (MEC) plans also fall under this category.

Although far from comprehensive, these plans may appeal to young, healthy consumers because of their lower premiums. Unfortunately, these plans sometimes limit people with preexisting conditions. That’s where pairing them with a direct primary membership can be extremely helpful. Most DPC memberships include maintenance of chronic diseases within manageable ranges, including those with preexisting conditions.

These plans are attractive to companies that employ low-skill workers with high turnover rates. Restaurants, retail operators, hotels, and other hospitality companies can benefit from combining direct primary care with a MEC or another skinny plan.

Hospital indemnity plans

Even a minor trip to the hospital can be a major financial setback for some. HDHPs offer coverage, but the average family often struggles to meet high deductibles in today’s economic climate. Paying a large portion out of pocket for hospital stays can add more hardship to an already stressful situation.

Hospital indemnity plans offer benefits for things like hospital admission, intensive care, and emergency room treatments. There are no deductibles to meet, and employees can also cover their spouses and children under these plans.

By pairing a hospital indemnity plan with a DPC membership, employees can get day-to-day health care for themselves and their dependents for little to no out-of-pocket costs. By utilizing unlimited primary care, people can also catch disease states and other acute conditions before they escalate to the point of requiring a hospital stay. In an emergency, having the added hospital indemnity can provide peace of mind for families already living paycheck to paycheck.

High deductible health plans/self-funding

Companies of all sizes have adopted high deductible health plans (HDHP) as a strategy to reduce the costs of providing health care. A great way to lessen the blow of an HDHP is to insert direct primary care. Others are looking to self-funding/level-funding options coupled with DPC to deflect claims and limit their overall premium expense.

With DPC, employees get day-to-day benefits for routine care. When employees use their DPC membership for primary and preventive care before engaging their HDHP or self-funded plan, they can minimize their out-of-pocket costs and avoid meeting costly deductibles for primary care. It’s also a win for the employer, because the fewer employees that use the health plan for routine care, the fewer insurance claims the employer must pay. Minimizing the cost of primary care for staff and lowering employers’ claims expenses make DPC an ideal partner.

Medical Cost Sharing

Medical cost-sharing plans are sometimes called healthcare ministries. They are not run by insurance companies; they are run by nonprofit organizations. Members pay a set amount into a group fund every month. When a member gets a large medical bill, the fund pays some or all of that bill. Plan guidelines spell out which expenses are shareable.

Before the plan pays out, though, the member must cover some of the cost first. This amount, called the member’s “personal responsibility” or “annual household portion,” works just like a deductible does for health insurance.

People choose these plans instead of health insurance because the monthly charges are usually lower. To control costs, some plans urge members to to join a direct primary care practice.

Times have already changed

Providing equitable and easily accessible health care for employees is no longer optional. Businesses are facing unprecedented challenges to recruit and retain quality talent. In addition to better pay, better benefits will be a determining factor to differentiate one employer from another. As a result, organizations focus on strategies that will help them stand out to candidates without exhausting their resources.

Now more than ever, it’s imperative for brokers to customize solutions for clients. Brokers who lack the savvy to build more cost-effective and robust health plans will lose to their more innovative competitors. Direct primary care is one of many non-traditional benefits that can add value to any health plan. It’s essential to educate yourself on the new options available in the health care marketplace so you don’t get left behind.

Creating custom solutions for clients is easier than you think. There are many options and product bundles available if brokers take the time to look. By expanding the resources available to employers, brokers can foster a partnership in which employers and their employees feel a greater sense of satisfaction with their benefit offerings. Working productively and strategically to offer more, while remaining cost-efficient, strengthens the entire health plan and, hopefully, the organization.

portion of this article from "Partnering on customizable benefit solutions yields powerful results" from Andy Bonner of Healthcare2u

More families abandoning health insurance for monthly medical memberships

With health care costs on the rise, a growing number of Americans are throwing out the old way of seeing a doctor and turning to a membership model. A monthly or annual fee gets you direct access to a doctor, no insurance needed.

This concept called Direct Primary Care (DPC) simplifies health care delivery, taking the focus away from visit volume and reimbursement, and allowing doctors to focus on patients and their needs. When reimbursement is not tied to individual visits, patients and physicians are free to have as much contact as required, whether in-person or virtual. Problems can be followed and resolved in real time instead of fragmented, spaced-out visits.

Physicians become invested in people, and patients learn to trust their physician again. This translates into significantly decreased ER and urgent care visits, decreased hospitalizations, increased patient satisfaction, and increased physician well-being, as found in a recent study done through Milliman by the Society of Actuaries and attested to by the hundreds of physicians already in DPC practices.

Using the DPC monthly membership model, physicians can decide how much time and attention their patients need without the onus of check boxes and insurance-based decision making. Each patient and the context of his or her ailments can be evaluated and treated on an individual basis:

■ The single mother whose child is sick with pneumonia can come to the clinic, receive a diagnosis, and get access to antibiotics without even having to stop at the pharmacy.

■ The 80-year-old patient who needs more time to move from the waiting room to patient room can now be seen and heard without the rush.

■ The 40-year-old with a broken ankle can get an x-ray, pay only $35 for that image, get a boot ordered from Amazon, and see a physical therapist on a cash basis, all for a fraction of what insurance would charge.

Patients can meet with the DPC doctor at the clinic or consult with him or her through email. Healthcare happens outside the office as well as inside, and patients with quick questions can simply avoid the drive to the office and speak to their DPC doctor on the phone or even email them.

Patient satisfaction, therefore, is fostered through convenience, instant-access to care, and safe discussion. Furthermore, with Direct Primary Care, physicians can realize efficacy and find purpose in their day-to-day interactions with patients, trusting that patient satisfaction will be the natural outcome.

Dr. Sharyl Truty is the physician-owner of a Direct Primary Care practice called Balanced Physician Care located in Ponte Vedra Beach, FL. She has been in practice as both a board-certified Family Medicine and a board-certified Sports Medicine physician for over 15 years. She has completed a fellowship in Integrative Medicine from the University of Arizona with Dr. Andrew Weil. Dr. Truty is committed to finding the best solutions to help you live the best-balanced life possible.

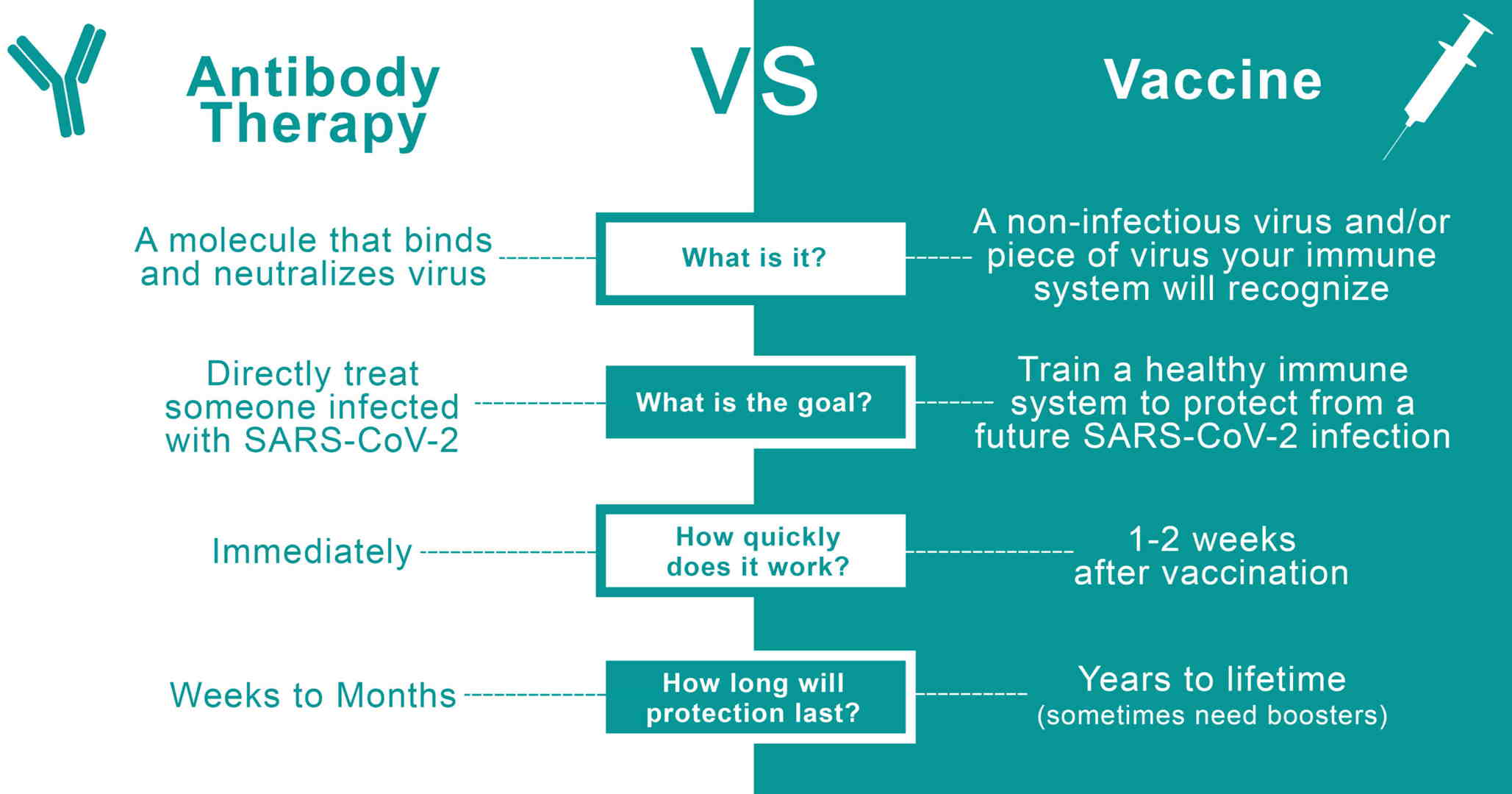

Monoclonal Antibody Therapy vs Covid Vaccine

Monoclonal antibody therapeutics and vaccines are two of the most effective ways to combat SARS-CoV-2 and subsequent COVID-19 disease. Although there are some similarities between these two methods, there are stark differences we should know.

What is an antibody and how does monoclonal antibody therapy work?

Similar to antibodies which are proteins that the body naturally produces to defend itself against disease, Monoclonal Antibodies are artificially created in the lab, tailor-made to fight the disease they treat. Casirivimab and Imdevimab are monoclonal antibodies that are specifically directed against the spike protein of SARS-CoV-2, designed to block the virus’ attachment and entry into human cells. Two distinct antibodies bind non-competitively to the COVID-19 virus cell surface and prevent the virus from infecting healthy cells. Using two antibodies protects against the emergence of resistance. Monoclonal antibody therapy is used to treat infections that have already occurred.

How does a vaccine work?

A vaccine, on the other hand, is what we refer to as "active immunity." A vaccine may be a fragment of a virus, an inactivated virus, or a live virus that is no longer infectious. When we inject this into an individual, the immune system responds as if the person were infected with SARS-CoV-2. However, the person will not become ill, and the assault will provide the inoculated person with what is known as "immune memory." Since the body has already learnt how to adapt to the virus, immune memory protects it from infection in the future, helping the body to clear SARS-CoV-2 before it can do any damage. This protective immunity may last for months, years or even a lifetime in certain cases. Vaccines are completely safe and will help people who are otherwise healthy avoid contracting COVID-19 in the future. Vaccines, however, use this to treat a patient who is already ill.

So, what's the difference between the two? Why do we need both?

- Monoclonal antibody therapies give the body antibodies to protect itself, resulting in passive immunity. Vaccines give active immunity by assisting the body in producing its own antibodies.

- Monoclonal antibody therapy treats those who are already infected with the COVID-19 virus. The vaccine trains the immune system to fight against the COVID-19 virus.

- Monoclonal antibody therapy starts working as soon as it is administered. The vaccine offers protection 1-2 weeks after the second dose is given

FDA approved Emergency Use Authorization or EUA for the REGENERON monoclonal antibody treatment. With the FDA's expanded authorization, Regeneron’s antibody cocktail can be given as an injection. The first dose needs to be administered within 96 hours of exposure.

Paging Doctor Google

All that being said, we get why patients don’t see the doctor. In this world of quick technology and easy answers, it’s tempting to go the Google route. But, what if you COULD have a doctor who is available to answer your question. What if she WAS available before Monday at 9am? What if he COULD call you back instead of one of his colleagues? What if it DIDN’T TAKE HOURS to hear back? Would you still Google?

While the answer for some of you may still be a vote for Dr. Google, we’re certain many others would prefer the expertise of a Board Certified Physician! To each, his/her own - BUT if you’d rather have the opinion of YOUR doctor right at the tip of your fingers, give Balanced Physician Care a try and find out why patients love the 24/7/365 access and connection to their Primary Care Doctor!

Balanced Physician Care is a Direct Primary Care practice located in Ponte Vedra Beach, Florida and serving all of Jacksonville's First Coast. Our physician-owner is Sharyl Truty MD. Visit BalancedPhysicianCare.com/membership for more information on how to become a member.

If Direct Primary Care Had a National Commercial

Direct Primary Care really is that easy. It's a "Progressive" way to get your primary care.

We’ll see how long until Progressive gets mad at us for using this. Until then, feel free to share. Send it to family. Whatever. We hope you get a chuckle out of it as well.

Courtesy of DPCNews.com.

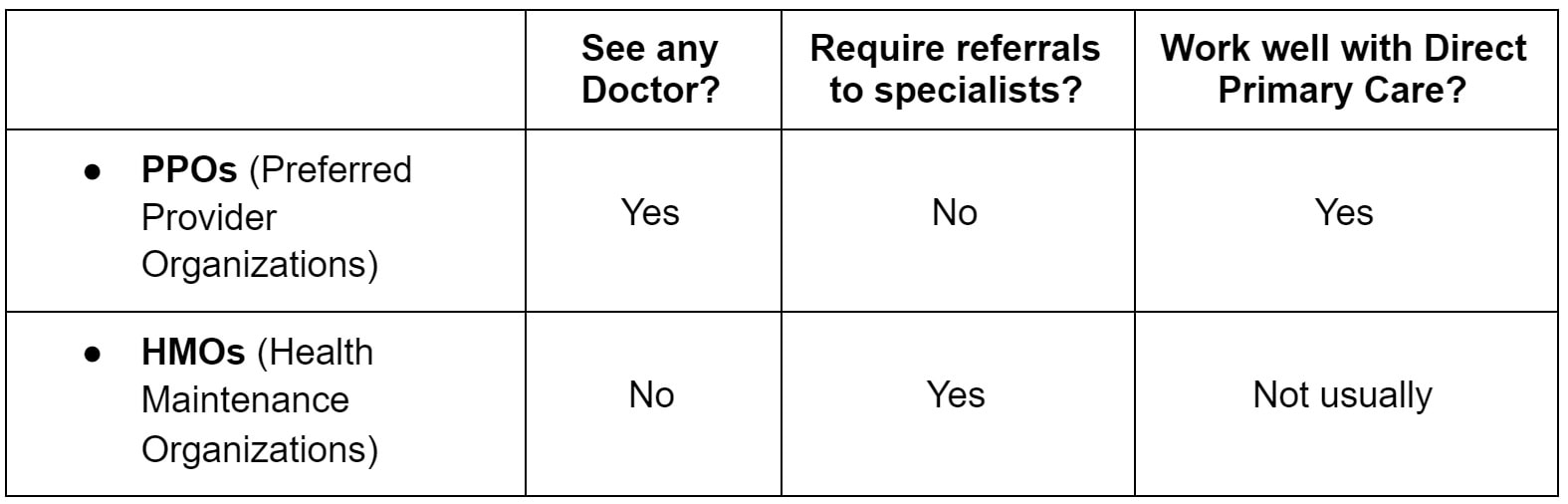

Is a HMO or PPO better with a Direct Primary Care practice

The short and sweet of it is that HMOs are very restrictive and want you to remain in their “network” - which means you need a Primary Care Physician who participates in the network with them. Such a physician has signed paperwork saying they will follow the insurance companies rules, only refer you where the insurance company says, and receive payment when they bill your insurance of a set rate.

On the other hand, PPOs are flexible. They allow you to go “out-of-network” - including not only any specialist you’d like to see but also any primary care doc! That’s why we encourage patients to check their insurance plan before joining our practice. If your plan is an HMO, it lets us (as out-of-network doctors) to care for you as you and we see fit. The gist is that we can see you, you can see who you want, and we are only paid by your monthly membership fee to be part of the practice.

If you’re a patient who has lots of specialists and needs help with coordination, likes the idea of a doctor who is not “on the hook” with the insurance companies, or just plain likes the idea that you can choose who you’d like to see - a PPO plan alongside a DPC doctor - like us at Balanced Physician Care! - might be the perfect match for you. And no it's not paying twice for healthcare, we think it’s making a smart choice for your health! For more on how we practice primary care differently in Jacksonville, FL, check us out at BalancedPhysicianCare.com

Tricare and Balanced Physician Care

TRICARE is an incredible benefit for members of the armed services and retirees, and a couple of its versions work exceptionally well with a Balanced Physician Care membership. The ability to get lab and imaging tests as well as some specialty care directly from the base means you can get the best of both worlds.

TRICARE SELECT

TRICARE Select (formerly TRICARE Standard) is a version that has small enrollment fee (like a premium) of $12.50 per month ($250 annually) individual and $25 per month ($300 annually) for a family

enrollment fee is waived if you’re:

- An active duty family member

- A medically retired retiree or family member

- A survivor of an active duty sponsor or medically retired retiree

A 20% cost-sharing (also known as co-insurance) for charges incurred outside of the “direct” system. Direct means you’re getting care, tests, or prescriptions directly from the military clinic. Pairing your Select plan with a direct primary care membership means you get fantastic, easy-to-access primary care for an affordable cost. No worries about getting in to be seen the day you call, and you’ll see your doctor when you do. Labs, imaging tests, and prescriptions can still be done at the base at no cost. If you need care that neither the membership nor the military clinic can provide, we work to make sure you know what something is going to cost before you go.

TRICARE FOR LIFE

TRICARE for Life is essentially second-payer coverage for Medicare for people 65+ or otherwise eligible for Medicare. It also works great with a Balanced Physician Care membership for the same reasons is works for TRICARE Select — affordable access to your doctor when you need it AND the ability to get tests and prescriptions from the base. We appreciate your service.

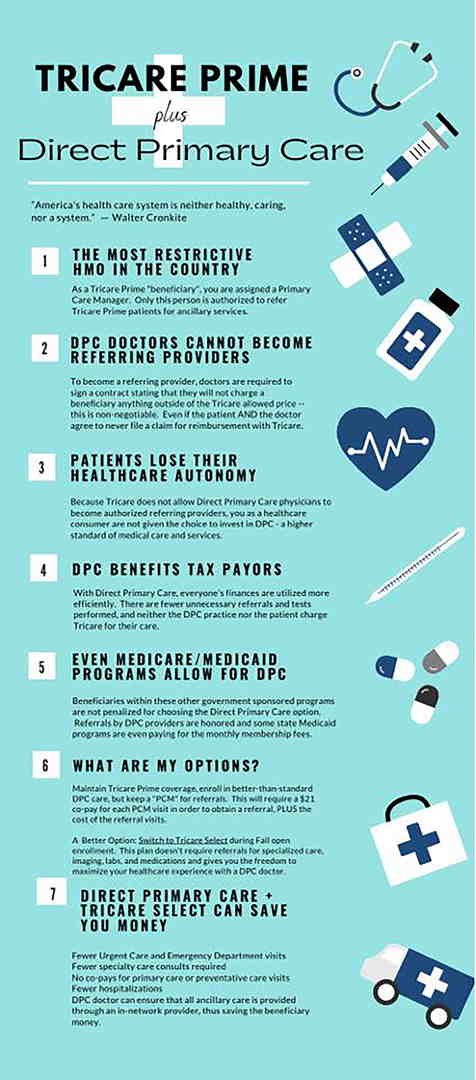

TRICARE PRIME

Unfortunately, Prime doesn’t work quite so well with a Balanced Physician Care membership. Prime functions like a “health maintenance organization” (whatever that is), which limits Balanced Physician Care’s ability to do referrals. It’s still an option, but you’d basically just have to operate outside the system.

The bottom line is that TRICARE Select and TRICARE for Life work great with a Balanced Physician Care membership — the relationship, access, and value we provide in our clinic combined with the ability to still get tests, medications, and specialty care at the base at no additional cost!

To learn more about the membership options at Balanced Physician Care. Visit our membership page

Direct Primary Care: Are the results worth the time, effort and money for employers?

Direct Primary Care makes complete sense as a concept. In the real world, of course, it’s a bit more messy and complicated, especially within the confines of an employer’s health plan, and finding the right pathway to achieve the desired results is sometimes tricky. Replacing the traditional entry point to a health care journey with a higher-performing primary care partner sounds ideal, up until the point when personal preferences and emotional bonds prove larger barriers than originally expected.

The main arguments against the traditional primary care pathway include:

- Providers get paid on a fee-for-service basis, so they are rewarded for managing chronic conditions and have no financial incentive for simply curing a condition.

- Primary care providers have to see too many patients in a day to meet the needs of a huge patient “panel.” Appointments are rushed, and rather than root-cause health care, only symptom-management is typically discussed.

- Primary care doctors often refer to specialists to protect from liability or malpractice claims.

- Upstream medical practices (i.e., more expensive providers such as hospitals) have purchased primary care providers to control the pathway to their services, and thus silently influence volume and referral patterns away from primary care treatment to their affiliated and more expensive providers and facilities.

The main value-propositions heralded by the DPC provider often include:

- Smaller patient “panels” equals more time spent with the patient (member).

- Money is spent to achieve wellness.

- Direct primary care is free from financial pressures and upstream interests.

- The DPC model focuses on a broader scope of services and refers to specialists less often.

So, yes, it’s easy to see how the employer or consumer starts to recognize the advantages of this strategy. If the employer shifts their money from paying for services and instead moves that investment into a direct primary care relationship, their employees should get better care through a relationship with a provider who is compensated to focus more time on their employees and have fewer upstream referrals for testing and specialist interventions.

Built-in or bolt-on options for employers

There are several factors that determine whether the membership fees that a direct primary care practice receives are paid on an invoice basis to the employer, or whether their health plan administrator or TPA will make that payment.

Fully insured scenarios

The first and easiest distinction is the fully insured health insurance plan and its relationship to DPC practices. This one is simple: There isn’t a relationship. The DPC practice has rejected the traditional fully insured plan and built a practice where that relationship is predominately viewed as toxic and unhealthy for the patient and the provider. If an employer wants to establish a DPC relationship for their employees and the employees’ family members, this is a “bolt-on” option. The employer will either pay a monthly invoice for the membership fees, or the employees will pay directly and get a reimbursement from their employer.

Now, if you’re wondering, “Why would an employer pay extra for a DPC membership on top of their high-cost health care?” you are not alone.

I asked Dr. James Pinckney of Diamond Physicians in Dallas about this during my very early investigation into DPC in my local community. His response was simple: It’s about access and providing a huge benefit. His clients who were doing this were looking to provide an unparalleled benefit, and this was a simple way to do so while showing interest in the wellness aspect of their employees’ lives through the DPC memberships.

Most brokers I’ve spoken with who have this arrangement often use a high-deductible plan as the insurance vehicle for these arrangements, either because they need to save some money on the insurance to finance the DPC investment, or because the client already had an HDHP and needed to find a solution to address the perceived barrier to care that the health plan’s deductible was creating in the minds of their employees.

Self-insured or level-funded scenarios

The self-insured health plan is a much easier vehicle to customize with a built-in DPC option. When working with a plan’s administrator, you can typically arrange a per member per month fee to be invoiced to the employer and then submitted to the DPC practice, or you can define how the membership will be paid from the plan’s claims funds each month.

Of course, the real world is more complex than that made it sound.

Not all self-funded or level-funded plan administrators are adaptable. Some will simply have a set number of plan designs and pre-set protocols that they can’t and shouldn’t deviate from due to their operations. Others will give great lip-service to the concept and promise to accommodate, then utterly fail when it comes to execution or implementation.

To be fair, this is still a new process and hasn’t yet been adopted by the masses. Thus, most are learning with us as we go. And a plan administrator that can’t coordinate the monthly membership fees shouldn’t be a deal-breaker. Most DPC practices actually prefer to receive their payments directly from the employer group. Running a DPC arrangement as a bolt-on solution is not a horrible outcome, even with a self-funded plan.

I talked to Josh Butler of Butler Benefits about his experience with the bolt-on approach as the purest relationship for the employer and the DPC practice. “I’ve seen two mindsets from our employers. They either want to work directly with the DPC providers and form a deeper partnership with them, or they want to see the health plan take care of the tactical aspects of the provider relationship.” When I asked him which he saw driving better results, he said, “What kind of question is that? You know the employer that gets their hands dirty finds the gold.”

But, there is still great upside potential in the self- and level-funded arenas for the DPC arrangement to take hold and multiply.

For one thing, upfront cost reductions are possible here. Some stop-loss vendors will give discounts for a plan that uses a DPC solution. I’ve seen quotes that reduced insurance costs in the $25 to $40 per member per month range, and I’ve heard from peers about even higher per employee savings.

Coupling this fixed cost savings with the plan’s year-round performance through reduced upstream costs each time a member avoids unnecessary or overpriced care should be sweet music to the employer’s ears.

Prescription costs are another area of concern for the self-funded health plan, and monitoring the prescription usage before and after implementing a DPC strategy can help shed light on the greater potential of this relationship. Prescription usage will obviously be a slower impact item, but having that higher engagement and the anecdotal data that most DPCs gather after blunt conversations about the cost of care and the cost of prescriptions will inevitably begin to assist the plan’s performance in this area.

Preparing for the complex scenarios

Inevitably, the actual implementation will be some variation or expansion on the simple DPC arrangement. There will be an adjustment to the concept based on discussions that arise with the employer and their leadership team. There will also likely be adjustments once all parties review prices from various DPC vendors and after employees provide their feedback.

More than one DPC vendor

You will need to be prepared to address the impact of geographical regions, which could include discussing a 20-minute drive across one city, a two-hour commute between different counties in the same state, or even coverage across multiple states.

Some DPC practices have grown their own geographical footprints to meet the needs of the customers they currently serve through hiring; some of those practices will also extend their billing and administrative services to other independent DPC practices to create a seamless experience for the employer group, while not having to own and staff a new region.

And there are software services that can leverage existing relationships to create custom networks of DPC practices. These services have really started refining their deployment, and while these services typically add expense to the setup and administration, the flexibility for a multi-location employer to deploy a DPC solution without spending the time to create individual relationships or band-aid geographic holes can be a huge value for the right clients.

Sharing DPC costs with the employee

This is where we come back to the built-in or bolt-on conversation. This is really a moot point in the built-in scenario when the plan or TPA administers the membership fees, and the employer has bundled everything into the traditional payroll deduction scenario. But, in the “bolt-on” or separate enrollment and billing scenario, things get more interesting.

Tom DiLiegro of Benefits Advisors of South Charleston has seen the full spectrum. “When the employer understands the impact and the savings at stake, they immediately want to pay for the membership fees in full. Once they start to consider employees who don’t go for routine care today, they start down the slippery slope of not wanting to pay for medical care on behalf of employees who don’t receive care today. Inevitably, they end up with a 75%/25% cost-sharing or 100% cost-sharing for a limited time, but then reduce or remove the employer portion of the DPC for those employees who don’t have their first visit within a set number of months into the new DPC arrangement.”

DPC and VDPC options and combinations

All DPCs have virtual care covered in their memberships; that is one of their main value propositions. Some even give price breaks for a virtual-only membership. But the emergence of 100% virtual primary care practices and the expansion of services offered by telemedicine solutions is going to be central to any DPC conversation.

My personal experience has been predominantly with the DPC/VDPC combination using two different vendors. The structure is to use a DPC for those in a reasonable geographical location, and a virtual-only vendor for employees who live in a region without a feasible DPC relationship, or a region without enough employees to establish a company-paid membership with a DPC provider. This isn’t always the solution that the DPC partner prefers, but the price point on these arrangements is often more palatable for the employer groups and the VDPC vendors are often easier for the employer to deploy.

Sherpaa founder and CEO Jay Parkinson’s prediction that care will be “primarily online and strategically in person” is increasingly likely and occurring a little quicker than even he expected when he offered this as a central theme to a talk he delivered in February 2020.

Worth it?

So many hurdles, shifting scenarios, and uncertainties beg the question: Are the results worth the time, effort and money?

This is about a journey in pursuit of a different result. When an employer, advisor or individual wants a reset on their health care expenditure, they need to try a new path. Whether the first step is a DPC arrangement, a virtual DPC, or even contracting directly with a traditional practice willing to perform in a more attentive and high-value manner similar to the ACO model, a new pathway that starts with primary care is a sensible place to start.

Savings might occur immediately, in year three, or might never be realized, but anything strategically done to lower costs and improve the health of a workforce has to be considered worthwhile.

Want to learn more about Direct Primary Care for your business? Visit our dedicated employer page - www.HealthcareforJax.com

- Article from Benefits Pro 4/7/21 -Bret Brummitt is a benefits consultant and the founder of Generous Benefits.